How will your portfolio

perform?

Are you a square or a ball?

We are not asking about your personality type. This is just a sample of the unique, patent-pending perspective that we bring to the table. The question pertains to a new way of looking at your portfolio that actually works.

Eric solved the problem

Our founder recognized that this was problematic and a contradiction to what his clients really desired to happen as a result of diversifying. Using science, he solved this investor diversification dilemma that was initially explained and articulated in his third book, Managing Risk: How to End Investment Volatility. In an improved (patent pending) method of looking at your portfolio, he demonstrated that a picture truly is worth a thousand words. By asking and answering, “You Are Square®” or “You Are A Ball®” relative to the design, the problem is solved.

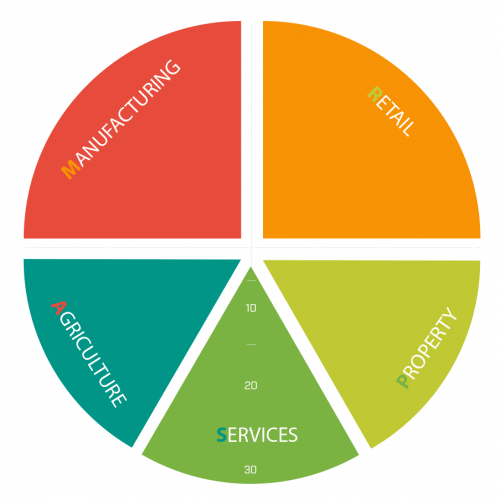

As the engineering axiom states, form must follow function. Generally speaking, today if you want to increase the odds of bouncing, your portfolio should be concentrated like a ball around the point of origin with zero or low yielding investments like the DOW, S&P 500 or retail investments. If, on the other hand, you want a portfolio that moves, one that provides double digit high, steady streams of income that also holds its value regardless as to the stock market’s gyrations, the picture should look different. Investments should be spread around the diagram with each providing high rates of return on investment that prudent investors crave.

In the long term, everyone’s objective is to state “I’m Square.®” At Conduit Investment Advisors, you don’t have to bounce erratically around like a Ball® by default. This is the case with conventional, “diversified,” low-to-no yield investments that on average take 30 to 100 years or more to breakeven on a cash flow basis (that is, if they provide a dividend at all). We can help you structure your portfolio to behave more like a Square®.

For specific advice on what you can do, contact Conduit Investment Advisors to get started.